Optical Module Industry Research Report 2022 - Competitive Landscape (4)

Competitive Landscape

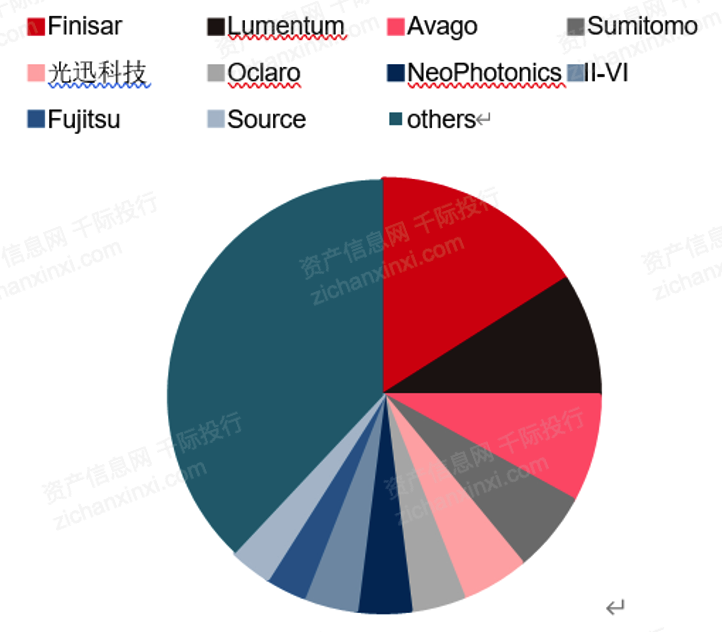

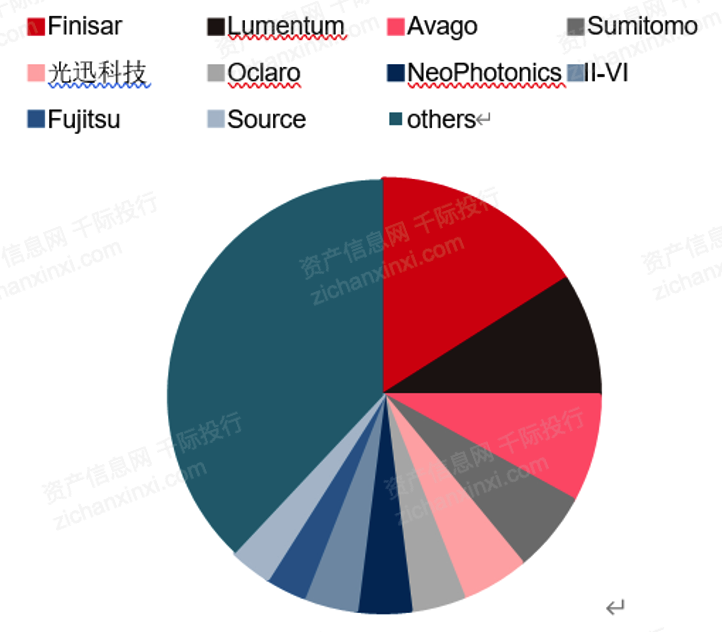

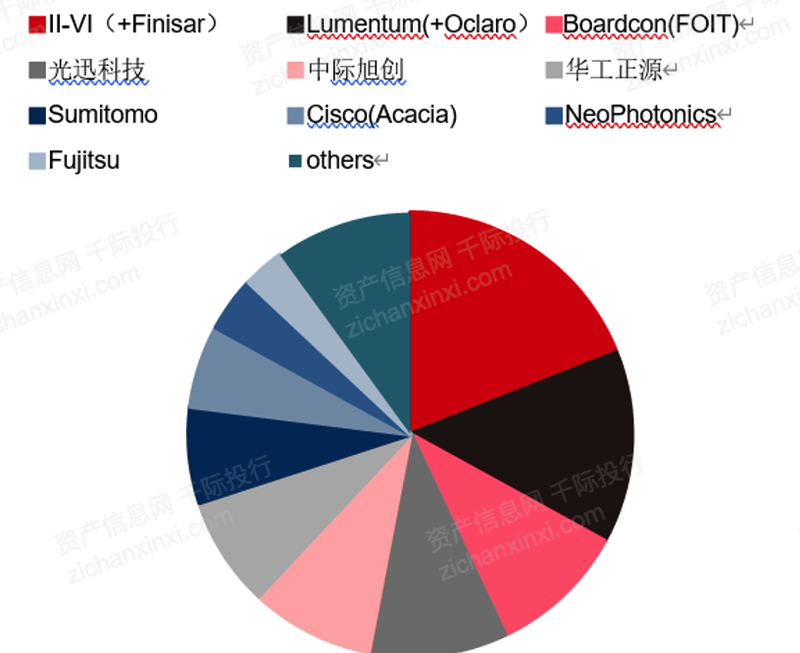

In 2015, the competitive landscape of the optical module market was highly fragmented, with less than 20% of the market share held by the leaders and single-digit market shares held by the remaining vendors. However, with the development of technology, research and development and expansion threshold continues to improve, the scale advantage of large leading manufacturers is becoming more and more significant. In addition, in recent years, optical module companies to accelerate mergers and acquisitions, vertical integration of the industry chain, industry concentration further improved, the global optical module market will gradually move towards concentration. cr5 has increased from 44% in 2015 to 62% in 2019.

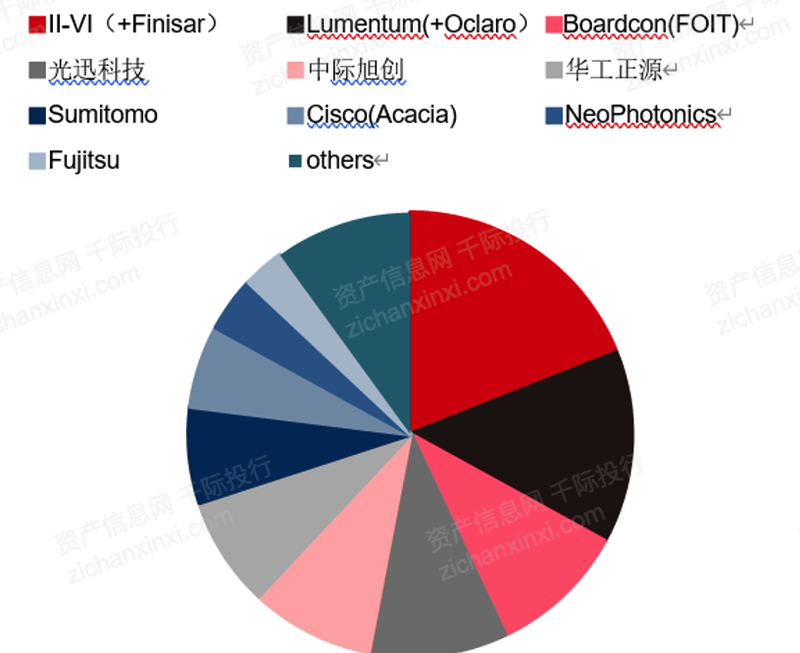

The share of domestic manufacturers is increasing. In 2015, the top 10 global optical module manufacturers are only one Chinese company, but in 2019, optical Xun Technology, Interlayer Xutron and Huagong Zhengyuan entered the global top 10, together occupying 27% of the global market share. We believe that Chinese optical module manufacturers are expected to continue to expand their advantages in the future and continue to erode the market share of overseas optical module manufacturers.

图:2015年全球光模块市场份额

资料来源:千际投行,资产信息网,OVUM,中信证券

图:2019年全球光模块市场份额

Source: Thousand Inter Investment Bank, Asset Information Network, OVUM, CITIC Securities

Chinese Competitors

Chinese competitors are mainly optical technology (002281. SZ), in the xucco (300308. SZ), Tianfu communication (300394. SZ), new eSun (300502. SZ), Cambridge technology (603083. SZ), Hongteng technology (06088), etc.

中际旭创(300308.SZ)

Founded in 2008, Suzhou Xutron is a typical venture capital-backed fast-growing company, with a Series C round of financing in 2014 including $38 million led by the famous Google Capital and Lightspeed venture capital funds. 2017, through restructuring and merging into Sino-Intelligent Equipment, the company was renamed Sino-Intelligent Xutron.

Zhongji Xuchuang is a technology innovation enterprise integrating optical communication device design, R&D and manufacturing, and intelligent equipment manufacturing. The company's business involves high-end optical communication modules, motor stator winding manufacturing equipment and other industrial fields. In recent years, the company has taken high-end optical communication transceiver module as its core business, and consolidated its leading position in global high-speed optical module by completing the research and development and small batch production of 400G digital communication optical module, meanwhile, the company actively improves the layout of the whole industry chain in 5G telecommunication field, realizes the dual-driven mode of "digital communication + telecommunication", and the revenue share continues to grow.

天孚通信(300394.SZ)

Ltd. is a leading provider of vertically integrated solutions for high-end passive devices and ODM/OEM for high-speed optical device packaging. The company has ten product lines, and its products are widely used in telecom communication, data center, IOT and other fields, and provides seven high-end passive device total solutions and high-speed optical device packaging OEM solutions.

The company focuses on the field of optical components and optical devices, creating a one-stop in-depth service for optical devices, and is in the upstream of the optical communication industry chain. Starting from high-precision silicon casing components, the company has become a platform company for one-stop solutions of precision components by continuously extending upstream production lines through endogenous R&D, external joint ventures and mergers and acquisitions.

新易盛(300502.SZ)

Ltd. was established in 2008, the company is a leading provider of optical transceiver solutions and services, mainly engaged in the research and development, manufacturing, sales and services of the full range of optical modules for telecommunications and digital communications; the company is committed to the implementation of vertical integration around the main industry, to achieve full coverage of optical device chip manufacturing, optical device chip packaging, optical device packaging and optical module manufacturing links.

At present, the company's optical communication products cover a variety of standard communication network interface, transmission rate, optical wavelength and other technical indicators, application areas covering data broadband, telecommunications communications, data centers, security monitoring and smart grid and other industries, products are sold to various countries and regions around the world. The company has successfully developed 400G optical modules for data centers and achieved full-rate coverage of optical modules.

Global Competitors

The main global competitors are Finisar (FNSR), Applied Optoelectronics (AAOI), NeoPhotonics (NPTN), Acacia Communications (ACIA), Oclaro (OCLR), etc.

Finisar菲尼萨(FNSR)

Finisar is a U.S. semiconductor device company founded in 1988 and listed on NASDAQ in 1999, with a current market capitalization of approximately $2.1 billion (approximately RMB 13.4 billion). After nearly 30 years of development, the company has become the world's largest manufacturer of optical communication device products. According to Ovum, Finisar's global market share of optical devices in 2016 was 14.8%, ranking No. 1.

With more than 14,000 employees, the company's main products include fiber optic transceivers, optical engines, active optical cables, optical devices, optical instruments, ROADM and WSS wavelength managers, optical amplifiers and optical carrier RF modules, which enable high-speed transmission of voice, video and data in networking, storage, wireless and cable applications.

Oclaro奥兰若(OCLR)

Oclaro Inc. (OCLR) is a semiconductor equipment and materials company headquartered in California, USA. The company is dedicated to the design and sale of optical components, modules and subsystems to the global communications, industrial and consumer markets. Oclaro was formed in 2009 through the merger of Bookham and Avanex, two former suppliers of optical communications components. bookham Technology, founded in 1988, was the first company to manufacture optical components that could be integrated into silicon integrated circuits. Oclaro designs, manufactures and markets optical components, optical modules and optical subsystems for a wide range of applications in communications, data transmission, aerospace, semiconductor, sensing, defense and scientific research.

NeoPhotonics(NPTN)

NeoPhotonics (NPTN) is the world's leading designer and manufacturer of devices, modules and subsystems for high-speed optical communication networks. Formerly Nano Gram Corporation, founded in 1996 to focus on nanotechnology and related product applications, the company changed its name to NeoPhotonics in 2002 and began to focus on the design, development and manufacturing of communications products.

NPTN's global headquarters is located in San Jose, California, with R&D and manufacturing facilities in the US, China, Japan, and Russia. Since 2003, the company has made a series of strategic acquisitions to gain leadership in photonic integrated circuit (PIC) and laser technology. 2013 saw the acquisition of the optical device business unit of LAPIS Semiconductor in Japan; 2015 saw the acquisition of EMCORE's ultra-narrow linewidth tunable laser business; and 2017 saw the sale of the access and low-speed transceiver product lines to APAT. During a series of mergers and acquisitions and restructuring, the company has continued to vertically integrate and has the ability to provide customers with high-speed lasers and optical modules to focus on the high-speed optical communication market.

Future Trends

In terms of the current development trend of optical modules, the main direction is towards high speed, miniaturization, low cost, low power consumption and long distance, but the primary premise is the optical chip.

High speed: currently being developed from 10G/40G to 100G/400G.

miniaturization: optical devices are required to develop in the direction of highly integrated, small packages, the physical volume should be small, but also full functionality.

Long distance: today's optical networks are being laid over increasingly long distances, which requires remote transceivers to match them.

Low cost and low power consumption: optical devices are required to reduce costs, improve the yield, and reduce energy consumption by using low voltage and other means.

Competitive Landscape

In 2015, the competitive landscape of the optical module market was highly fragmented, with less than 20% of the market share held by the leaders and single-digit market shares held by the remaining vendors. However, with the development of technology, research and development and expansion threshold continues to improve, the scale advantage of large leading manufacturers is becoming more and more significant. In addition, in recent years, optical module companies to accelerate mergers and acquisitions, vertical integration of the industry chain, industry concentration further improved, the global optical module market will gradually move towards concentration. cr5 has increased from 44% in 2015 to 62% in 2019.

The share of domestic manufacturers is increasing. In 2015, the top 10 global optical module manufacturers are only one Chinese company, but in 2019, optical Xun Technology, Interlayer Xutron and Huagong Zhengyuan entered the global top 10, together occupying 27% of the global market share. We believe that Chinese optical module manufacturers are expected to continue to expand their advantages in the future and continue to erode the market share of overseas optical module manufacturers.

图:2015年全球光模块市场份额

资料来源:千际投行,资产信息网,OVUM,中信证券

图:2019年全球光模块市场份额

Source: Thousand Inter Investment Bank, Asset Information Network, OVUM, CITIC Securities

Chinese Competitors

Chinese competitors are mainly optical technology (002281. SZ), in the xucco (300308. SZ), Tianfu communication (300394. SZ), new eSun (300502. SZ), Cambridge technology (603083. SZ), Hongteng technology (06088), etc.

中际旭创(300308.SZ)

Founded in 2008, Suzhou Xutron is a typical venture capital-backed fast-growing company, with a Series C round of financing in 2014 including $38 million led by the famous Google Capital and Lightspeed venture capital funds. 2017, through restructuring and merging into Sino-Intelligent Equipment, the company was renamed Sino-Intelligent Xutron.

Zhongji Xuchuang is a technology innovation enterprise integrating optical communication device design, R&D and manufacturing, and intelligent equipment manufacturing. The company's business involves high-end optical communication modules, motor stator winding manufacturing equipment and other industrial fields. In recent years, the company has taken high-end optical communication transceiver module as its core business, and consolidated its leading position in global high-speed optical module by completing the research and development and small batch production of 400G digital communication optical module, meanwhile, the company actively improves the layout of the whole industry chain in 5G telecommunication field, realizes the dual-driven mode of "digital communication + telecommunication", and the revenue share continues to grow.

天孚通信(300394.SZ)

Ltd. is a leading provider of vertically integrated solutions for high-end passive devices and ODM/OEM for high-speed optical device packaging. The company has ten product lines, and its products are widely used in telecom communication, data center, IOT and other fields, and provides seven high-end passive device total solutions and high-speed optical device packaging OEM solutions.

The company focuses on the field of optical components and optical devices, creating a one-stop in-depth service for optical devices, and is in the upstream of the optical communication industry chain. Starting from high-precision silicon casing components, the company has become a platform company for one-stop solutions of precision components by continuously extending upstream production lines through endogenous R&D, external joint ventures and mergers and acquisitions.

新易盛(300502.SZ)

Ltd. was established in 2008, the company is a leading provider of optical transceiver solutions and services, mainly engaged in the research and development, manufacturing, sales and services of the full range of optical modules for telecommunications and digital communications; the company is committed to the implementation of vertical integration around the main industry, to achieve full coverage of optical device chip manufacturing, optical device chip packaging, optical device packaging and optical module manufacturing links.

At present, the company's optical communication products cover a variety of standard communication network interface, transmission rate, optical wavelength and other technical indicators, application areas covering data broadband, telecommunications communications, data centers, security monitoring and smart grid and other industries, products are sold to various countries and regions around the world. The company has successfully developed 400G optical modules for data centers and achieved full-rate coverage of optical modules.

Global Competitors

The main global competitors are Finisar (FNSR), Applied Optoelectronics (AAOI), NeoPhotonics (NPTN), Acacia Communications (ACIA), Oclaro (OCLR), etc.

Finisar菲尼萨(FNSR)

Finisar is a U.S. semiconductor device company founded in 1988 and listed on NASDAQ in 1999, with a current market capitalization of approximately $2.1 billion (approximately RMB 13.4 billion). After nearly 30 years of development, the company has become the world's largest manufacturer of optical communication device products. According to Ovum, Finisar's global market share of optical devices in 2016 was 14.8%, ranking No. 1.

With more than 14,000 employees, the company's main products include fiber optic transceivers, optical engines, active optical cables, optical devices, optical instruments, ROADM and WSS wavelength managers, optical amplifiers and optical carrier RF modules, which enable high-speed transmission of voice, video and data in networking, storage, wireless and cable applications.

Oclaro奥兰若(OCLR)

Oclaro Inc. (OCLR) is a semiconductor equipment and materials company headquartered in California, USA. The company is dedicated to the design and sale of optical components, modules and subsystems to the global communications, industrial and consumer markets. Oclaro was formed in 2009 through the merger of Bookham and Avanex, two former suppliers of optical communications components. bookham Technology, founded in 1988, was the first company to manufacture optical components that could be integrated into silicon integrated circuits. Oclaro designs, manufactures and markets optical components, optical modules and optical subsystems for a wide range of applications in communications, data transmission, aerospace, semiconductor, sensing, defense and scientific research.

NeoPhotonics(NPTN)

NeoPhotonics (NPTN) is the world's leading designer and manufacturer of devices, modules and subsystems for high-speed optical communication networks. Formerly Nano Gram Corporation, founded in 1996 to focus on nanotechnology and related product applications, the company changed its name to NeoPhotonics in 2002 and began to focus on the design, development and manufacturing of communications products.

NPTN's global headquarters is located in San Jose, California, with R&D and manufacturing facilities in the US, China, Japan, and Russia. Since 2003, the company has made a series of strategic acquisitions to gain leadership in photonic integrated circuit (PIC) and laser technology. 2013 saw the acquisition of the optical device business unit of LAPIS Semiconductor in Japan; 2015 saw the acquisition of EMCORE's ultra-narrow linewidth tunable laser business; and 2017 saw the sale of the access and low-speed transceiver product lines to APAT. During a series of mergers and acquisitions and restructuring, the company has continued to vertically integrate and has the ability to provide customers with high-speed lasers and optical modules to focus on the high-speed optical communication market.

Future Trends

In terms of the current development trend of optical modules, the main direction is towards high speed, miniaturization, low cost, low power consumption and long distance, but the primary premise is the optical chip.

High speed: currently being developed from 10G/40G to 100G/400G.

miniaturization: optical devices are required to develop in the direction of highly integrated, small packages, the physical volume should be small, but also full functionality.

Long distance: today's optical networks are being laid over increasingly long distances, which requires remote transceivers to match them.

Low cost and low power consumption: optical devices are required to reduce costs, improve the yield, and reduce energy consumption by using low voltage and other means.