Optical Module Industry Research Report 2022 - Business Models and Technology Development (2)

Business Model and Technology Development

Industry Chain Analysis

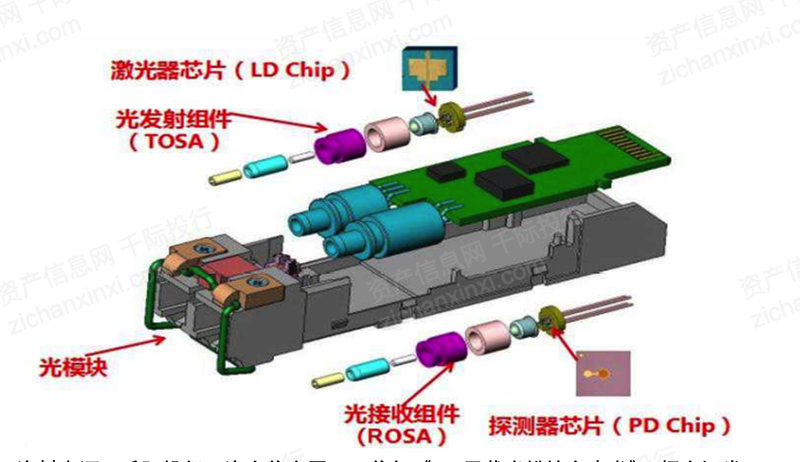

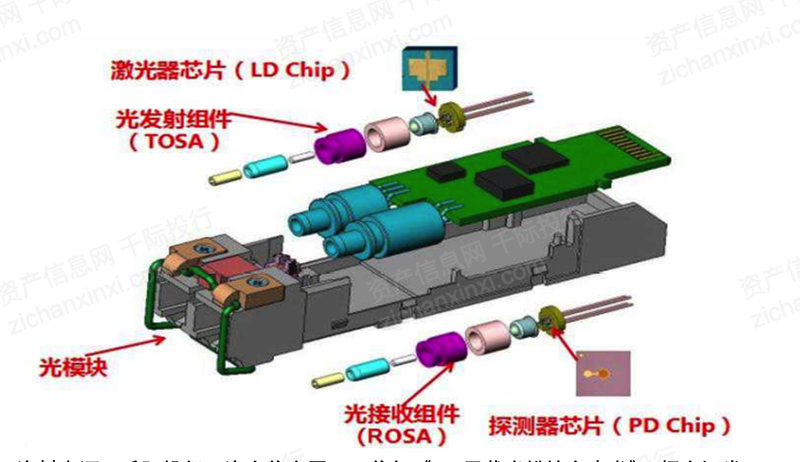

Higher technical barriers and complex processes, optical chip in the optical module cost accounted for a relatively high. The main body of TOSA is the laser chip (VCSEL, DFB, EML, etc.), and the main body of ROSA is the detector chip (APD/PIN, etc.). (APD/PIN, etc.).

With the market demand for high speed optical modules, the performance requirements of optical chips and manufacturing process difficulties in increasing, optical chips in optical devices and optical modules in the cost ratio to further increase, according to the analysis of public information, the general optical modules in the optical chip cost ratio between 30-40%, in the high-end high-speed optical modules, this ratio can reach about 50%.

图:SFP封装光模块的结构图

资料来源:千际投行,资产信息网,工信部《5G承载光模块白皮书》,招商证券

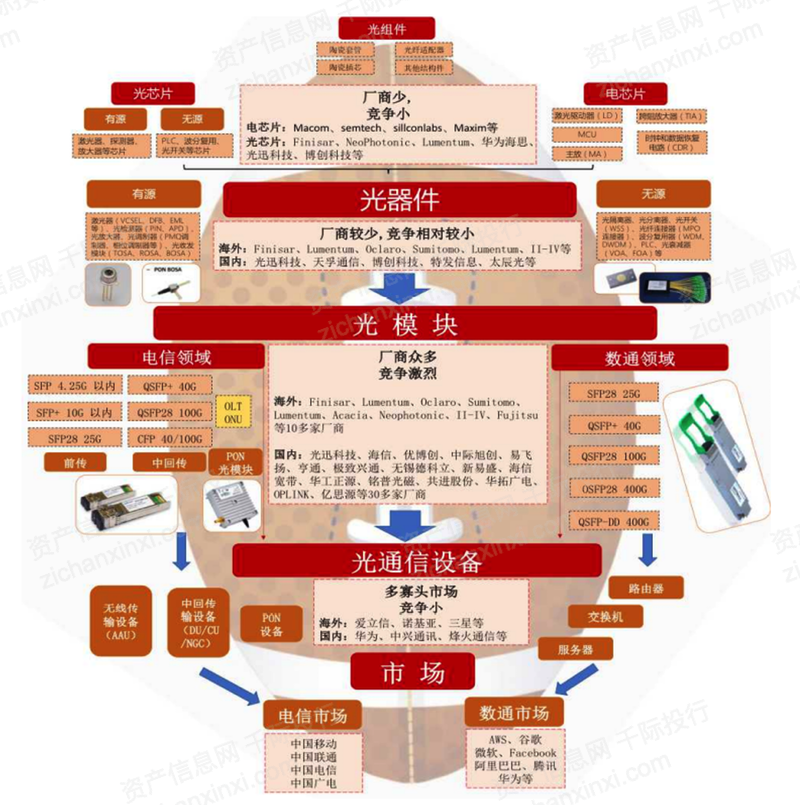

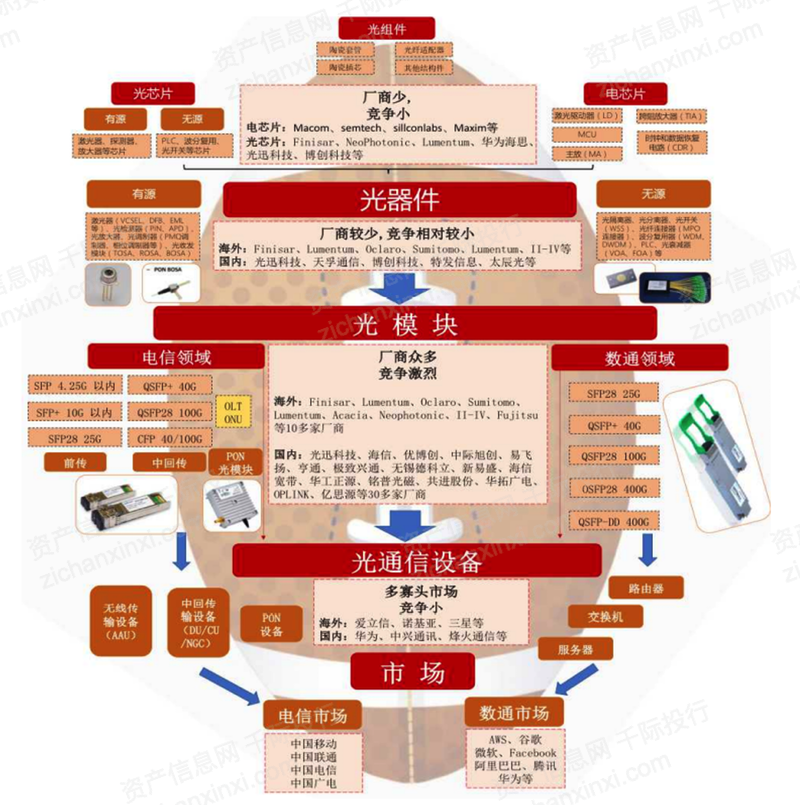

The competition pattern of the optical module industry chain is rugby-ball distributed, the upstream chip and downstream equipment competition pattern is established, with technology and capital monopoly advantage, the midstream competition is more intense, there are many module manufacturers, upgrade to high-end products to become an important way for optical module manufacturers to stand out.

The optical module industry chain can be roughly divided into four major segments: "chips -> devices -> modules -> equipment". The upstream chip, device and downstream equipment markets have fewer competitors, but control the supply and demand side of the industry chain and have a greater impact. The midstream modules are relatively low technology threshold, and there are more participants, especially the low-end and low-speed optical module packaging manufacturers, so the market competition is intense. In the case of small technical differences, the fierce competition is ultimately reflected in the price fight of optical modules, optical module manufacturers' gross margins and performance under greater pressure, optical module manufacturers hope to occupy a place in the high-end market by upgrading to high-end 400G digital pass and 25G front transmission optical modules.

Upstream

Mainly includes chips, components and optical devices composed of both. Chips include optical chips and electrical chips, which account for a larger part of the value of the entire optical module, while its performance and capacity have a more profound impact on the optical module industry chain due to the high technical threshold and fewer suppliers. Maintaining a secure supply chain operation is particularly important to the operation of optical module manufacturers. At present, the high-end optical and electrical chips have a low domestic rate and are more dependent on imports. Optical components are mainly passive components and structural parts, and some high-end products involve precision processing fields, which also have a high technical threshold.

Midstream

The packaging production of optical modules can be divided into telecom field and digital communication field according to different application scenarios, both of which have similar appearance and functional role, but the internal structure is different, and the supply chain and downstream customers are also different. As there are more application scenarios for optical modules and wide demand for specific models, the production capacity requirements for low, medium and high performance optical modules are different, the strength of corresponding manufacturers varies, and the overall competition is high, but products involving high-end and high-speed are still in the blue ocean market.

Downstream

According to the scene of optical modules corresponding to the downstream customers can be divided into two categories, telecommunications customers and Internet customers. Telecom customers mainly include equipment manufacturers and network construction operators of telecom network equipment such as wireless base stations, transmission systems, PON networks, etc.; Internet customers are equipment manufacturers and users of servers, switches and routers related to data centers that have emerged in recent years. The two markets are very different but have a close business relationship with each other, and need to be analyzed together to have an accurate grasp of the overall optical module market.

图:橄榄型格局分布的光通信产业链

资料来源:千际投行,资产信息网,招商证券

According to a recent survey report by Light Counting, five optical module vendors from China, such as CIIXtron, Hisense, Optotec, Huagong Zhengyuan and Xinyisheng, are expected to enter the global top 10 in 2020 and dominate the global optical module market, compared to 2010 when only one Chinese company entered the top 10. In 2010, only one Chinese company entered the top ten. Sinostar is expected to end Finisar's "streak" in 2020, topping the top 10 ranking for optical modules.

The report was released without taking into account the impact of the new crown virus outbreak, but now China has taken the lead in emerging from the shadow of the new crown epidemic, with most regions having resumed production, while Europe and the US are still deeply affected by the new crown epidemic. Combined with the recent acceleration of China's 5G network and data center construction, China's optical communication industry is expected to take the lead in a strong recovery period, and Chinese optical module manufacturers are expected to further increase their global market share.

Technology Development and Business Model

Due to the complexity and high cost of active WDM implementation, the industry chain support for semi-active WDM solutions has yet to be improved. Based on industry research and the analysis of 5G base stations that need to be quickly put on the ground to form networks, both active WDM and semi-active WDM solutions do not have competitive advantages in terms of industry chain support maturity and price cost. The main.

Fiber direct drive gray optical module

In 2020, fiber direct drive will still be the most important solution for 5G wireless forwarding. Based on the expected scale of 5G wireless base station construction in 2020, which will far exceed that of 2019, the demand for 25G gray optical modules in 2020 will continue the trend of rapid growth and release last year. Fiber direct drive is the traditional 5G forward transmission scheme, using mainly gray optical modules with transmission distance of 300m and 10km. Gray optical module business model is generally unified by the wireless base station equipment vendors to optical module manufacturers to purchase, and with the equipment vendors produced by the wireless base station with sales to operators. The market is mainly Hisense broadband, Huagong technology, optical technology, new eSun and other shipments, the competitive pattern is more stable.

图:灰光模块商业模式

资料来源:千际投行,资产信息网,招商证券

Passive WDM Color Optical Module

Passive wavelength division is a common forward transmission technology, commercially available mainly in CWDM scheme. The main function is to multiplex the original multiple signals of different wavelengths into a single signal at the transmitting end, and transmit it through a single fiber, and demultiplex the signal into multiple signals of different wavelengths at the receiving end to transmit to the corresponding equipment, the equipment involved in the whole transmission process are passive devices, which is the main feature different from active wavelength division (OTN).

The common passive WDM equipment mainly consists of three parts: color optical module, WDM and frame auxiliary materials. Passive WDM is commonly used in environments where fiber resources are tight and can effectively reduce the demand for fiber resources for transmission. At present, the commonly used passive WDM technology mainly includes CWDM, LWDM and MWDM, etc. The technical difference is mainly the difference in working wavelength. Currently, CWDM technology is widely used commercially, i.e. coarse wavelength division multiplexing technology, and the maturity of the industry chain is high. CWDM technology provides a total of 18 wavelengths from 1271nm to 1611nm, with each working wavelength spacing of 20nm. 12 wavelengths and 18 wavelengths of CWDM.

Passive WDM is the most important application scenario of color optical module in forward transmission. With the scale construction of 5G base station in 2020, as one of the main solutions of wireless front transmission, passive wavelength division equipment is expected to open up the market space and become the main engine to pull the color optical module. Recently, the three major operators have entered the group company or provincial branch procurement peak, of which, in 2020 China Mobile has tendered for the purchase of more than 10.6 million sets of passive wave equipment, China Telecom collection of more than 150,000 sets of passive wavelength division equipment, which also verifies our judgment of passive wavelength division solution to become the mainstream solution for front transmission. Unlike the business model of gray light modules, which are packaged and sold by communication equipment vendors, color light modules are generally obtained by passive wavelength division equipment vendors through self-production or outsourcing, and then sold to operators with passive wavelength division equipment produced by wavelength division equipment vendors.

图:彩光模块商业模式

资料来源:千际投行,资产信息网,招商证券

Policy Regulation

Industry Self-Regulatory Associations

(1) Institute of Electrical and Electronics Engineers (IEEE)

The Institute of Electrical and Electronics Engineers (IEEE), or IEEE for short, headquartered in New York, USA, is an international association of engineers in electronics and information science, and is the world's largest non-profit professional and technical society. IEEE was formed by the merger of the American Institute of Electrical Engineers and the Institute of Radio Engineers in 1963 and has more than 430,000 members worldwide. As the world's largest professional and technical organization, IEEE publishes 30% of the world's technical literature of its kind in the fields of electrical and electronic engineering, computers, and communications.

IEEE is committed to the development and research in electrical, electronic, and computer engineering and science-related fields, and has developed more than 1,300 industry standards in the fields of space, computers, telecommunications, biomedical, electric power, and consumer electronics, and has developed into an international academic organization with a large influence.

(2) China Communications Standards Association (CCSA)

China Communications Standards Association (CCSA) was officially established in Beijing on December 18, 2002. The association is a non-profit corporate social group which is organized by domestic enterprises and institutions voluntarily, approved by the competent business department and registered by the national association registration authority to carry out standardization activities in the field of communication technology. The main task of the Association is to better carry out research on communication standards, to organize enterprises and institutions concerned with standards, such as communication operators, manufacturing enterprises, research units and universities, to develop standards in accordance with the principles of fairness, impartiality and openness, to coordinate and gatekeep standards, to recommend high technology, high level and high quality standards to the government, to promote standards with our own intellectual property rights to the world, to Support China's communications industry and contribute to the world communications.

The association adopts the unit membership system, widely absorbing scientific research, technology development, design units, product manufacturing enterprises, communication operation enterprises, colleges and universities, associations and other organizations to participate. The Association follows the principles of openness, fairness, impartiality and consensus in organizing communication standardization research activities, and contributes to the development of the national communication industry by studying communication standards and conducting technical business consulting. The Association is entrusted by the competent business departments to organize standardization work in the field of communications technology.

(3) China Electronic Components Association (CECA)

China Electronic Components Association, abbreviated as CECA, the English name: China Electronic Components Association, abbreviated as: CECA. the Association by the Ministry of Civil Affairs of the People's Republic of China (1988) No. 198 approval of the Civil Society letter, was formally established on November 16, 1988, the business unit in charge of the People's Republic of China Ministry of Industry and Information Technology of the People's Republic of China. CECA is a national industry organization voluntarily formed by enterprises (business) units in the same industry, approved and registered by the Ministry of Civil Affairs, and is not restricted by sector, region or ownership, and has the qualification of a social organization legal person.

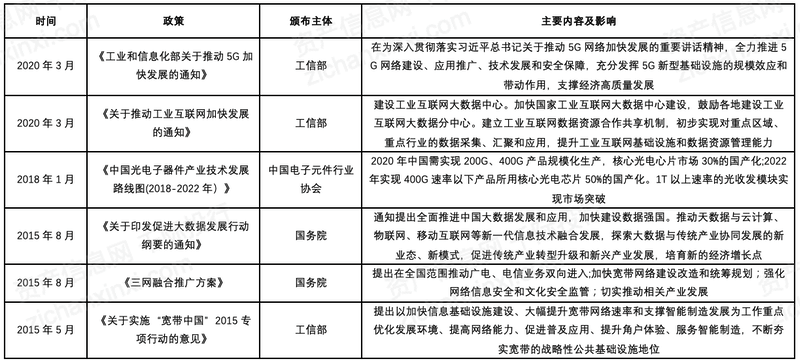

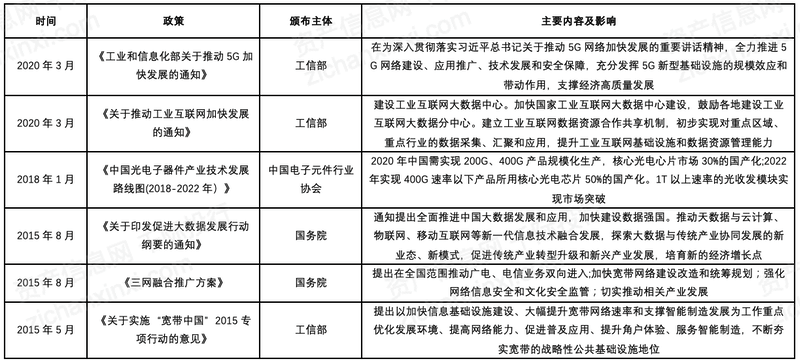

Government laws and regulations

Optical module is the core of modern information optoelectronics technology field of optoelectronic devices, more widely used, and data centers, 5G bearer network construction is closely related. Because of its importance, our government has promulgated a series of relevant policies to support the sustainable development of the optical module industry. In March 2020, the Ministry of Industry and Information Technology issued the Notice on Promoting the Accelerated Development of the Industrial Internet to build an industrial Internet data center. Establish a mechanism for cooperation and sharing of industrial Internet data resources, initially realize data collection, convergence and application for key regions and key industries, and improve industrial Internet infrastructure and data resource management capabilities.

表:光模块行业相关政策

资料来源:千际投行,资产信息网,工信部,国务院,中国电子元件行业协会

Business Model and Technology Development

Industry Chain Analysis

Higher technical barriers and complex processes, optical chip in the optical module cost accounted for a relatively high. The main body of TOSA is the laser chip (VCSEL, DFB, EML, etc.), and the main body of ROSA is the detector chip (APD/PIN, etc.). (APD/PIN, etc.).

With the market demand for high speed optical modules, the performance requirements of optical chips and manufacturing process difficulties in increasing, optical chips in optical devices and optical modules in the cost ratio to further increase, according to the analysis of public information, the general optical modules in the optical chip cost ratio between 30-40%, in the high-end high-speed optical modules, this ratio can reach about 50%.

图:SFP封装光模块的结构图

资料来源:千际投行,资产信息网,工信部《5G承载光模块白皮书》,招商证券

The competition pattern of the optical module industry chain is rugby-ball distributed, the upstream chip and downstream equipment competition pattern is established, with technology and capital monopoly advantage, the midstream competition is more intense, there are many module manufacturers, upgrade to high-end products to become an important way for optical module manufacturers to stand out.

The optical module industry chain can be roughly divided into four major segments: "chips -> devices -> modules -> equipment". The upstream chip, device and downstream equipment markets have fewer competitors, but control the supply and demand side of the industry chain and have a greater impact. The midstream modules are relatively low technology threshold, and there are more participants, especially the low-end and low-speed optical module packaging manufacturers, so the market competition is intense. In the case of small technical differences, the fierce competition is ultimately reflected in the price fight of optical modules, optical module manufacturers' gross margins and performance under greater pressure, optical module manufacturers hope to occupy a place in the high-end market by upgrading to high-end 400G digital pass and 25G front transmission optical modules.

Upstream

Mainly includes chips, components and optical devices composed of both. Chips include optical chips and electrical chips, which account for a larger part of the value of the entire optical module, while its performance and capacity have a more profound impact on the optical module industry chain due to the high technical threshold and fewer suppliers. Maintaining a secure supply chain operation is particularly important to the operation of optical module manufacturers. At present, the high-end optical and electrical chips have a low domestic rate and are more dependent on imports. Optical components are mainly passive components and structural parts, and some high-end products involve precision processing fields, which also have a high technical threshold.

Midstream

The packaging production of optical modules can be divided into telecom field and digital communication field according to different application scenarios, both of which have similar appearance and functional role, but the internal structure is different, and the supply chain and downstream customers are also different. As there are more application scenarios for optical modules and wide demand for specific models, the production capacity requirements for low, medium and high performance optical modules are different, the strength of corresponding manufacturers varies, and the overall competition is high, but products involving high-end and high-speed are still in the blue ocean market.

Downstream

According to the scene of optical modules corresponding to the downstream customers can be divided into two categories, telecommunications customers and Internet customers. Telecom customers mainly include equipment manufacturers and network construction operators of telecom network equipment such as wireless base stations, transmission systems, PON networks, etc.; Internet customers are equipment manufacturers and users of servers, switches and routers related to data centers that have emerged in recent years. The two markets are very different but have a close business relationship with each other, and need to be analyzed together to have an accurate grasp of the overall optical module market.

图:橄榄型格局分布的光通信产业链

资料来源:千际投行,资产信息网,招商证券

According to a recent survey report by Light Counting, five optical module vendors from China, such as CIIXtron, Hisense, Optotec, Huagong Zhengyuan and Xinyisheng, are expected to enter the global top 10 in 2020 and dominate the global optical module market, compared to 2010 when only one Chinese company entered the top 10. In 2010, only one Chinese company entered the top ten. Sinostar is expected to end Finisar's "streak" in 2020, topping the top 10 ranking for optical modules.

The report was released without taking into account the impact of the new crown virus outbreak, but now China has taken the lead in emerging from the shadow of the new crown epidemic, with most regions having resumed production, while Europe and the US are still deeply affected by the new crown epidemic. Combined with the recent acceleration of China's 5G network and data center construction, China's optical communication industry is expected to take the lead in a strong recovery period, and Chinese optical module manufacturers are expected to further increase their global market share.

Technology Development and Business Model

Due to the complexity and high cost of active WDM implementation, the industry chain support for semi-active WDM solutions has yet to be improved. Based on industry research and the analysis of 5G base stations that need to be quickly put on the ground to form networks, both active WDM and semi-active WDM solutions do not have competitive advantages in terms of industry chain support maturity and price cost. The main.

Fiber direct drive gray optical module

In 2020, fiber direct drive will still be the most important solution for 5G wireless forwarding. Based on the expected scale of 5G wireless base station construction in 2020, which will far exceed that of 2019, the demand for 25G gray optical modules in 2020 will continue the trend of rapid growth and release last year. Fiber direct drive is the traditional 5G forward transmission scheme, using mainly gray optical modules with transmission distance of 300m and 10km. Gray optical module business model is generally unified by the wireless base station equipment vendors to optical module manufacturers to purchase, and with the equipment vendors produced by the wireless base station with sales to operators. The market is mainly Hisense broadband, Huagong technology, optical technology, new eSun and other shipments, the competitive pattern is more stable.

图:灰光模块商业模式

资料来源:千际投行,资产信息网,招商证券

Passive WDM Color Optical Module

Passive wavelength division is a common forward transmission technology, commercially available mainly in CWDM scheme. The main function is to multiplex the original multiple signals of different wavelengths into a single signal at the transmitting end, and transmit it through a single fiber, and demultiplex the signal into multiple signals of different wavelengths at the receiving end to transmit to the corresponding equipment, the equipment involved in the whole transmission process are passive devices, which is the main feature different from active wavelength division (OTN).

The common passive WDM equipment mainly consists of three parts: color optical module, WDM and frame auxiliary materials. Passive WDM is commonly used in environments where fiber resources are tight and can effectively reduce the demand for fiber resources for transmission. At present, the commonly used passive WDM technology mainly includes CWDM, LWDM and MWDM, etc. The technical difference is mainly the difference in working wavelength. Currently, CWDM technology is widely used commercially, i.e. coarse wavelength division multiplexing technology, and the maturity of the industry chain is high. CWDM technology provides a total of 18 wavelengths from 1271nm to 1611nm, with each working wavelength spacing of 20nm. 12 wavelengths and 18 wavelengths of CWDM.

Passive WDM is the most important application scenario of color optical module in forward transmission. With the scale construction of 5G base station in 2020, as one of the main solutions of wireless front transmission, passive wavelength division equipment is expected to open up the market space and become the main engine to pull the color optical module. Recently, the three major operators have entered the group company or provincial branch procurement peak, of which, in 2020 China Mobile has tendered for the purchase of more than 10.6 million sets of passive wave equipment, China Telecom collection of more than 150,000 sets of passive wavelength division equipment, which also verifies our judgment of passive wavelength division solution to become the mainstream solution for front transmission. Unlike the business model of gray light modules, which are packaged and sold by communication equipment vendors, color light modules are generally obtained by passive wavelength division equipment vendors through self-production or outsourcing, and then sold to operators with passive wavelength division equipment produced by wavelength division equipment vendors.

图:彩光模块商业模式

资料来源:千际投行,资产信息网,招商证券

Policy Regulation

Industry Self-Regulatory Associations

(1) Institute of Electrical and Electronics Engineers (IEEE)

The Institute of Electrical and Electronics Engineers (IEEE), or IEEE for short, headquartered in New York, USA, is an international association of engineers in electronics and information science, and is the world's largest non-profit professional and technical society. IEEE was formed by the merger of the American Institute of Electrical Engineers and the Institute of Radio Engineers in 1963 and has more than 430,000 members worldwide. As the world's largest professional and technical organization, IEEE publishes 30% of the world's technical literature of its kind in the fields of electrical and electronic engineering, computers, and communications.

IEEE is committed to the development and research in electrical, electronic, and computer engineering and science-related fields, and has developed more than 1,300 industry standards in the fields of space, computers, telecommunications, biomedical, electric power, and consumer electronics, and has developed into an international academic organization with a large influence.

(2) China Communications Standards Association (CCSA)

China Communications Standards Association (CCSA) was officially established in Beijing on December 18, 2002. The association is a non-profit corporate social group which is organized by domestic enterprises and institutions voluntarily, approved by the competent business department and registered by the national association registration authority to carry out standardization activities in the field of communication technology. The main task of the Association is to better carry out research on communication standards, to organize enterprises and institutions concerned with standards, such as communication operators, manufacturing enterprises, research units and universities, to develop standards in accordance with the principles of fairness, impartiality and openness, to coordinate and gatekeep standards, to recommend high technology, high level and high quality standards to the government, to promote standards with our own intellectual property rights to the world, to Support China's communications industry and contribute to the world communications.

The association adopts the unit membership system, widely absorbing scientific research, technology development, design units, product manufacturing enterprises, communication operation enterprises, colleges and universities, associations and other organizations to participate. The Association follows the principles of openness, fairness, impartiality and consensus in organizing communication standardization research activities, and contributes to the development of the national communication industry by studying communication standards and conducting technical business consulting. The Association is entrusted by the competent business departments to organize standardization work in the field of communications technology.

(3) China Electronic Components Association (CECA)

China Electronic Components Association, abbreviated as CECA, the English name: China Electronic Components Association, abbreviated as: CECA. the Association by the Ministry of Civil Affairs of the People's Republic of China (1988) No. 198 approval of the Civil Society letter, was formally established on November 16, 1988, the business unit in charge of the People's Republic of China Ministry of Industry and Information Technology of the People's Republic of China. CECA is a national industry organization voluntarily formed by enterprises (business) units in the same industry, approved and registered by the Ministry of Civil Affairs, and is not restricted by sector, region or ownership, and has the qualification of a social organization legal person.

Government laws and regulations

Optical module is the core of modern information optoelectronics technology field of optoelectronic devices, more widely used, and data centers, 5G bearer network construction is closely related. Because of its importance, our government has promulgated a series of relevant policies to support the sustainable development of the optical module industry. In March 2020, the Ministry of Industry and Information Technology issued the Notice on Promoting the Accelerated Development of the Industrial Internet to build an industrial Internet data center. Establish a mechanism for cooperation and sharing of industrial Internet data resources, initially realize data collection, convergence and application for key regions and key industries, and improve industrial Internet infrastructure and data resource management capabilities.

表:光模块行业相关政策

资料来源:千际投行,资产信息网,工信部,国务院,中国电子元件行业协会