Optical Module Industry Research Report 2022 - Industry Development and Market Competition (3)

Industry development and market competition

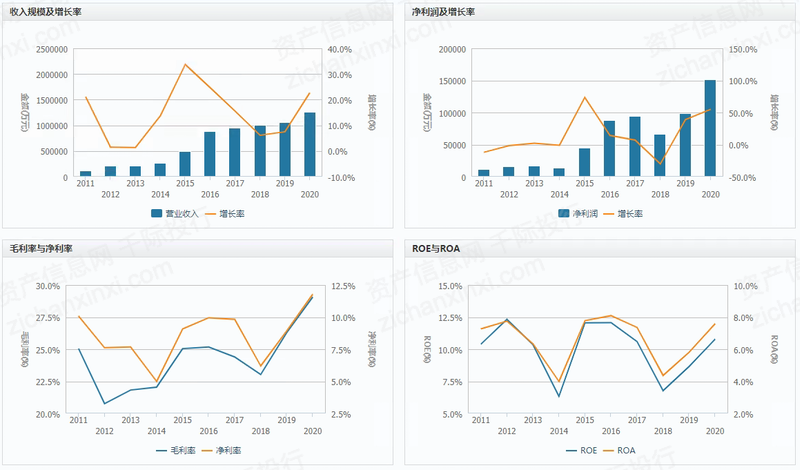

Industry Financial Analysis

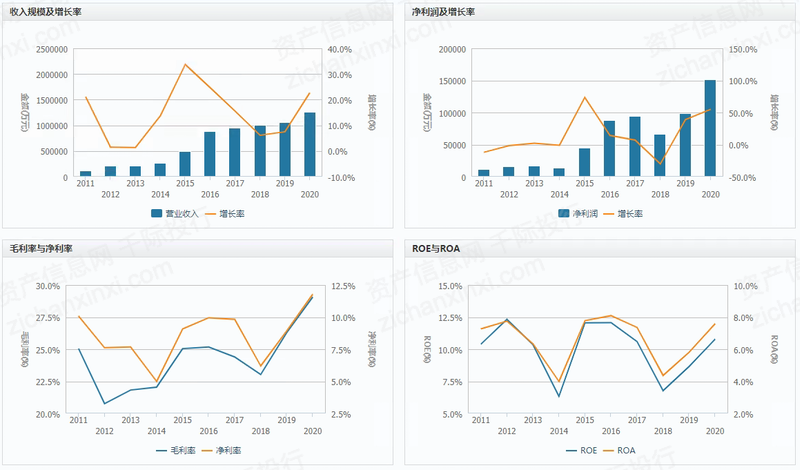

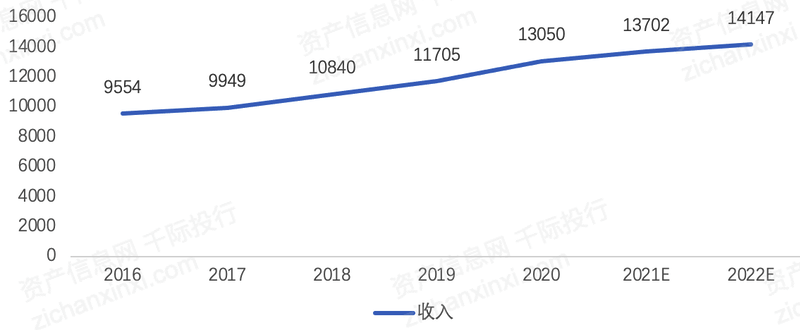

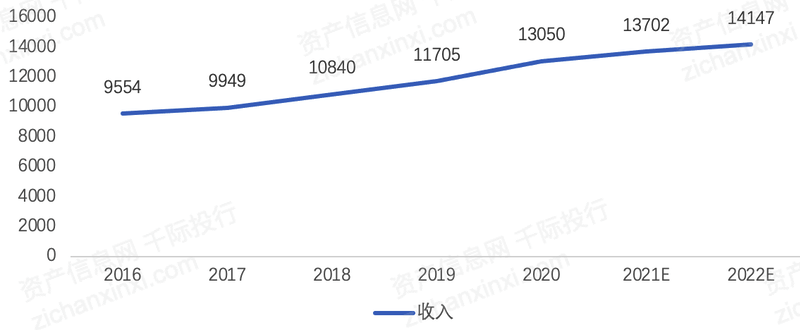

图:行业综合财务分析

资料来源:千际投行,资产信息网,Wind

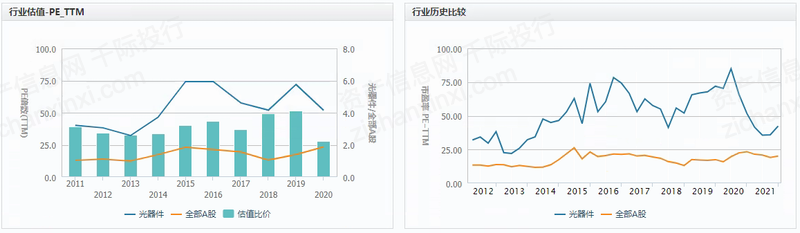

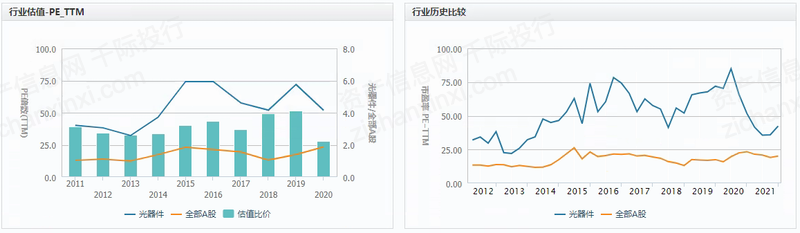

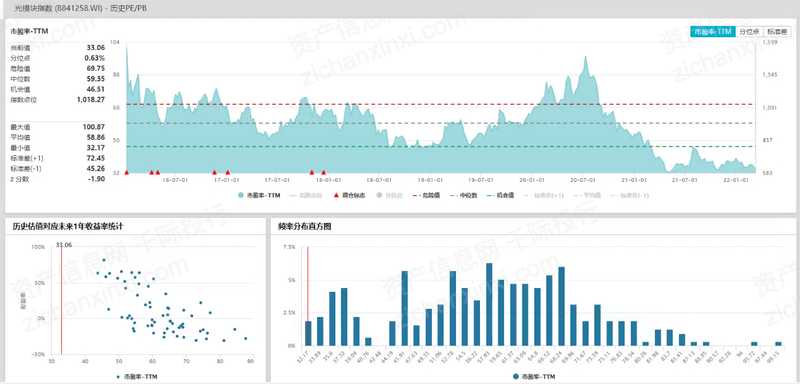

图:行业历史估值

资料来源:千际投行,资产信息网,Wind

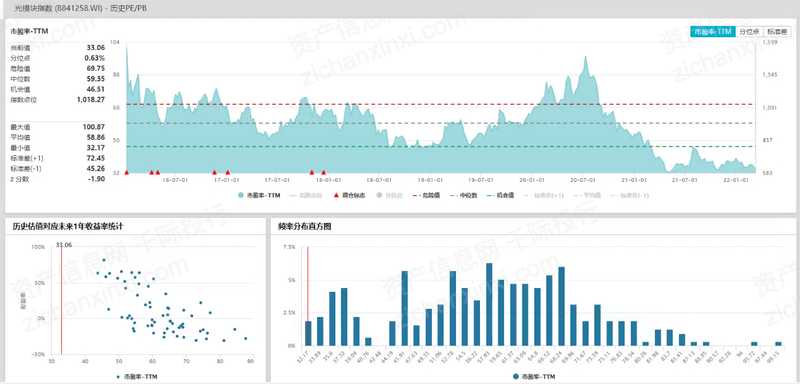

图:指数市场表现

资料来源:千际投行,资产信息网,Wind

图:指数历史估值

资料来源:千际投行,资产信息网,Wind

Valuation methods can be selected from P/E valuation method, PEG valuation method, P/N ratio valuation method, market present value, P/S market sales rate valuation method, EV/Sales market sales rate valuation method, RNAV revaluation of net assets valuation method, EV/EBITDA valuation method, DDM valuation method, DCF discounted cash flow valuation method, NAV net asset value valuation method, etc.

图:主要上市公司

资料来源:千际投行,资产信息网,Wind

图:中际旭创主营构成

资料来源:千际投行,资产信息网,Wind

图:天孚通信主营构成

资料来源:千际投行,资产信息网,Wind

Risk Factor Analysis

Risk of increased market competition

As domestic and foreign counterparts have joined the competition in the DTH and 5G markets in recent years and continue to develop new products and reduce production costs, it will make the competition among optical module manufacturers at the same technology level increasingly intense. In response, the company will take advantage of the technology and market advantages it already has, actively carry out technology and product innovation, increase cost reduction and efficiency, vigorously explore the market, continuously improve market competitiveness and consolidate its position in the industry.

Risk of technology upgrade

Optical module has a high technical content and is a high-tech field formed by the interpenetration and intersection of multiple disciplines such as optical and electrical. With the rapid growth of traffic demand and the rapid development of cloud computing data center network technology, the technology upgrade and iteration of optical module is fast. In this regard, the company has been committed to tracking the development of cutting-edge technology in the industry, attaching importance to the R&D talent pool and increasing the efforts in R&D investment to ensure that the core technology is iterated and upgraded in a timely manner according to market demand, which will form a strong support for the rapid growth of performance in the medium and long term.

Industry cyclicality risk

The company's two existing main businesses are highly correlated with macroeconomic and industry capital expenditure and fixed asset investment, and have certain cyclical characteristics. When the economy is in a down cycle, the high correlation will have a certain negative impact on the production and operation of the company. The company will actively promote the relevant industrial integration, enrich the product structure and market structure, thicken the capital accumulation, and ensure the sustainable development of the company.

Market Development Status

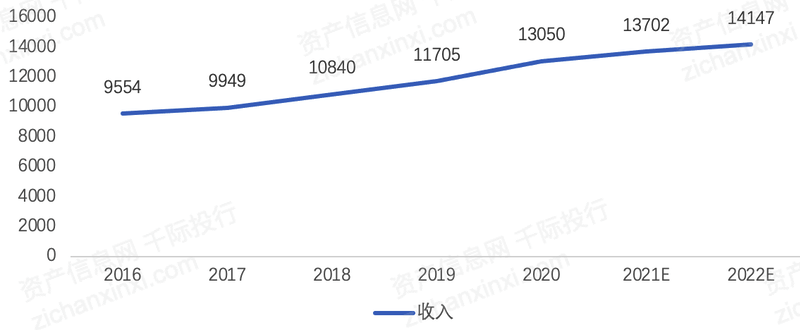

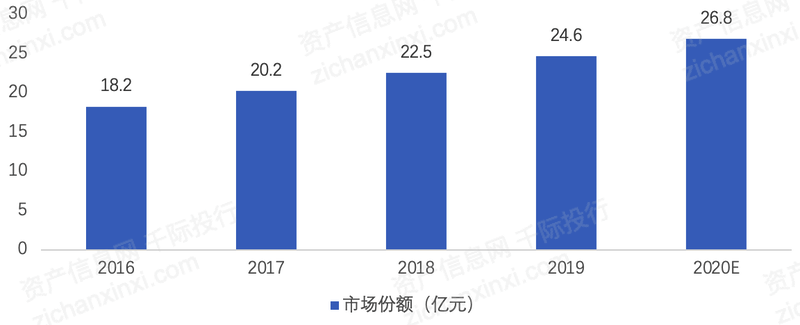

Since 2016, China's optical module market size has maintained rapid growth, and by 2018 China's optical module market size reached 2.25 billion yuan, and is expected to reach 2.68 billion yuan by 2020. According to Ovum data, the global optical communication device market size reached $10.8 billion in 2018, with a compound annual growth rate of about 7%, and optical modules account for 20-25% market share of the optical communication device market, the telecommunications market and data communication market demand for optical communication devices to maintain the growth trend, the access network market demand tends to stabilize. at the end of 2017, the Ministry of Industry and Information Technology issued the Technology Roadmap for Optical Electronic Devices", pointing out that the backwardness of high-end optical communication devices has become a bottleneck limiting the development of China's information industry, suggesting that the state should increase financial support for the research and development of optical devices, improve the localization rate of core devices, and cultivate an internationally competitive optical communication leader.

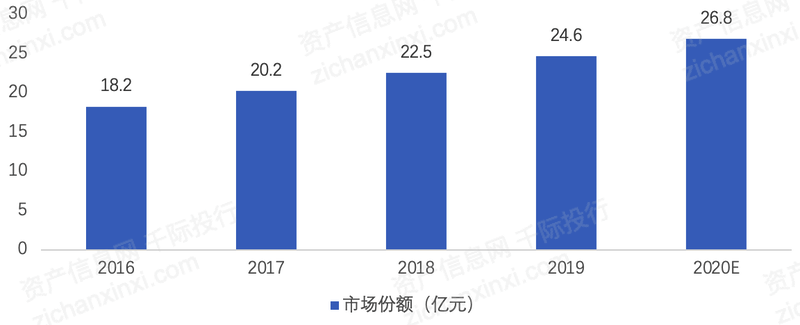

图:2016-2020年中国光模块市场规模及预测

资料来源:千际投行,资产信息网

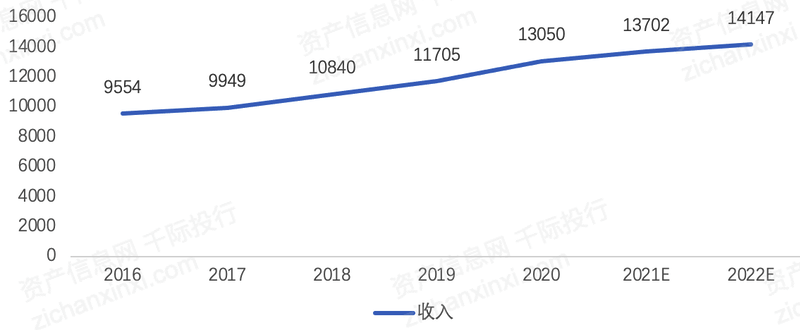

图:光通信器件全球市场规模(百万美元)

资料来源:千际投行,资产信息网,OVUM,华辰资本

Optical chip is the most concentrated value in the optical module, the cost of optical modules accounted for 30% -50%, the proportion of high-end products can even reach 50% -70%, foreign manufacturers occupy more than 90% of the market share of high-end optical chip, currently monopolized by the United States, Japan manufacturers.

With the continued growth of wired broadband and mobile broadband users, especially with the increase in the penetration of wired home broadband and the average household bandwidth to 100Mb / s, 1Gb / s upgrade, as well as the future development of 5G, will further promote operators to carry out metropolitan networks, backbone network expansion and upgrade. Therefore, high-speed optical components / optical modules will usher in a new round of high-speed growth cycle, and optical modules and optical chips will accelerate the replacement of localization.

表:5G光模块市场规模预测(单位:亿元)

资料来源:千际投行,资产信息网,工信部,华辰资本

With the capital expenditure of North American data center giants picking up and destocking coming to an end, the demand for optical modules in the datacom market will gradually recover and the price drop will narrow. 2019 Q2 global sales of 100G PSM4, CWDM4, LR4 and ER4Lite modules have achieved significant growth, among which, with the advantages of low price and wide application areas, 100GCWDM4 modules are becoming According to the data of Wise Research Consulting, the proportion of CWDM4 in 100G is expected to increase from 40.2% in 2018 to 47.6% in 2020. In addition, according to Light Counting forecasts, demand for optical products of 200GbE and above (including all 200GbE, 2x200GbE, 400GbE) is increasing, and the global optical module market will return to double-digit growth, with a CAGR growth rate expected to remain at 15% through 2024. On the price side, after experiencing a significant price decline driven by 100G in 2017-2018 (100G prices fell by as much as 50% in 2018), the average annual slope of decline in the price of digital-to-optical modules will resume a slower trend and is expected to fall to an average price level of US$1/Gb in 2024. The related price declines narrowed significantly in 2019, and the average price decline for digital-to-optical modules will narrow further in 2020, returning to historical averages.

Industry development and market competition

Industry Financial Analysis

图:行业综合财务分析

资料来源:千际投行,资产信息网,Wind

图:行业历史估值

资料来源:千际投行,资产信息网,Wind

图:指数市场表现

资料来源:千际投行,资产信息网,Wind

图:指数历史估值

资料来源:千际投行,资产信息网,Wind

Valuation methods can be selected from P/E valuation method, PEG valuation method, P/N ratio valuation method, market present value, P/S market sales rate valuation method, EV/Sales market sales rate valuation method, RNAV revaluation of net assets valuation method, EV/EBITDA valuation method, DDM valuation method, DCF discounted cash flow valuation method, NAV net asset value valuation method, etc.

图:主要上市公司

资料来源:千际投行,资产信息网,Wind

图:中际旭创主营构成

资料来源:千际投行,资产信息网,Wind

图:天孚通信主营构成

资料来源:千际投行,资产信息网,Wind

Risk Factor Analysis

Risk of increased market competition

As domestic and foreign counterparts have joined the competition in the DTH and 5G markets in recent years and continue to develop new products and reduce production costs, it will make the competition among optical module manufacturers at the same technology level increasingly intense. In response, the company will take advantage of the technology and market advantages it already has, actively carry out technology and product innovation, increase cost reduction and efficiency, vigorously explore the market, continuously improve market competitiveness and consolidate its position in the industry.

Risk of technology upgrade

Optical module has a high technical content and is a high-tech field formed by the interpenetration and intersection of multiple disciplines such as optical and electrical. With the rapid growth of traffic demand and the rapid development of cloud computing data center network technology, the technology upgrade and iteration of optical module is fast. In this regard, the company has been committed to tracking the development of cutting-edge technology in the industry, attaching importance to the R&D talent pool and increasing the efforts in R&D investment to ensure that the core technology is iterated and upgraded in a timely manner according to market demand, which will form a strong support for the rapid growth of performance in the medium and long term.

Industry cyclicality risk

The company's two existing main businesses are highly correlated with macroeconomic and industry capital expenditure and fixed asset investment, and have certain cyclical characteristics. When the economy is in a down cycle, the high correlation will have a certain negative impact on the production and operation of the company. The company will actively promote the relevant industrial integration, enrich the product structure and market structure, thicken the capital accumulation, and ensure the sustainable development of the company.

Market Development Status

Since 2016, China's optical module market size has maintained rapid growth, and by 2018 China's optical module market size reached 2.25 billion yuan, and is expected to reach 2.68 billion yuan by 2020. According to Ovum data, the global optical communication device market size reached $10.8 billion in 2018, with a compound annual growth rate of about 7%, and optical modules account for 20-25% market share of the optical communication device market, the telecommunications market and data communication market demand for optical communication devices to maintain the growth trend, the access network market demand tends to stabilize. at the end of 2017, the Ministry of Industry and Information Technology issued the Technology Roadmap for Optical Electronic Devices", pointing out that the backwardness of high-end optical communication devices has become a bottleneck limiting the development of China's information industry, suggesting that the state should increase financial support for the research and development of optical devices, improve the localization rate of core devices, and cultivate an internationally competitive optical communication leader.

图:2016-2020年中国光模块市场规模及预测

资料来源:千际投行,资产信息网

图:光通信器件全球市场规模(百万美元)

资料来源:千际投行,资产信息网,OVUM,华辰资本

Optical chip is the most concentrated value in the optical module, the cost of optical modules accounted for 30% -50%, the proportion of high-end products can even reach 50% -70%, foreign manufacturers occupy more than 90% of the market share of high-end optical chip, currently monopolized by the United States, Japan manufacturers.

With the continued growth of wired broadband and mobile broadband users, especially with the increase in the penetration of wired home broadband and the average household bandwidth to 100Mb / s, 1Gb / s upgrade, as well as the future development of 5G, will further promote operators to carry out metropolitan networks, backbone network expansion and upgrade. Therefore, high-speed optical components / optical modules will usher in a new round of high-speed growth cycle, and optical modules and optical chips will accelerate the replacement of localization.

表:5G光模块市场规模预测(单位:亿元)

资料来源:千际投行,资产信息网,工信部,华辰资本

With the capital expenditure of North American data center giants picking up and destocking coming to an end, the demand for optical modules in the datacom market will gradually recover and the price drop will narrow. 2019 Q2 global sales of 100G PSM4, CWDM4, LR4 and ER4Lite modules have achieved significant growth, among which, with the advantages of low price and wide application areas, 100GCWDM4 modules are becoming According to the data of Wise Research Consulting, the proportion of CWDM4 in 100G is expected to increase from 40.2% in 2018 to 47.6% in 2020. In addition, according to Light Counting forecasts, demand for optical products of 200GbE and above (including all 200GbE, 2x200GbE, 400GbE) is increasing, and the global optical module market will return to double-digit growth, with a CAGR growth rate expected to remain at 15% through 2024. On the price side, after experiencing a significant price decline driven by 100G in 2017-2018 (100G prices fell by as much as 50% in 2018), the average annual slope of decline in the price of digital-to-optical modules will resume a slower trend and is expected to fall to an average price level of US$1/Gb in 2024. The related price declines narrowed significantly in 2019, and the average price decline for digital-to-optical modules will narrow further in 2020, returning to historical averages.