Demand for 400G and above rate optical modules will become mainstream in the next five years

In 2020 and 2021, there is a major shift towards working from home and home schooling under the embargo policies resulting from the new Crown Pneumonia, creating a greater demand for faster, more ubiquitous, and more reliable networks. As a result, the optical module market has seen double-digit growth for two consecutive years, despite supply chain constraints and even disruptions.2022, the epidemic is gradually being brought under control globally, but some of the habits adopted during the crisis (remote working, collaboration, online media consumption) have become part of people's daily lives, connectivity is becoming a more important asset for homes and businesses, and demand for broadband continues to grow. As a result, the global optical module market is experiencing double-digit growth, despite the supply chain challenges that remain.

Specifically, global optical module revenue growth was driven by the three application markets of DWDM, Ethernet, and PON, with strong demand for 400G coherent products for telecom DCI applications in the DWDM market. Revenue growth in the Ethernet market came mainly from 200G and 400G products. In the PON optical module market, growth drivers are almost exclusively from XG/XGS-PON OLTs.

Over the next five years, applications such as cloud computing, IoT, and artificial intelligence will continue to stimulate rapid growth in demand for Internet traffic, driving market demand for higher-rate optical module products.

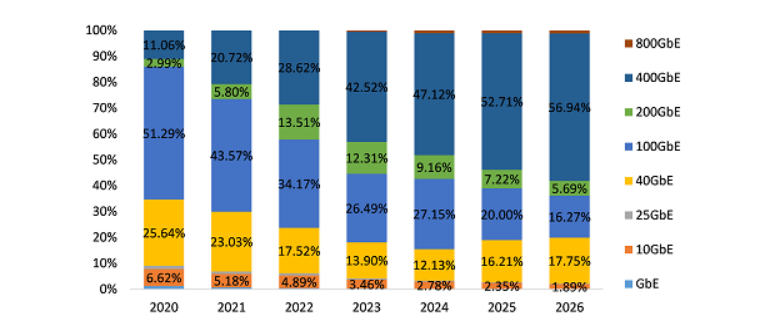

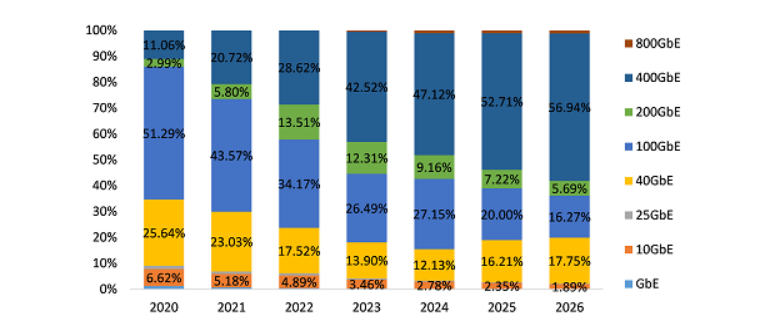

图1:不同速率DWDM模块渗透率发展趋势(按出货量)

数据来源:Omdia,ICC

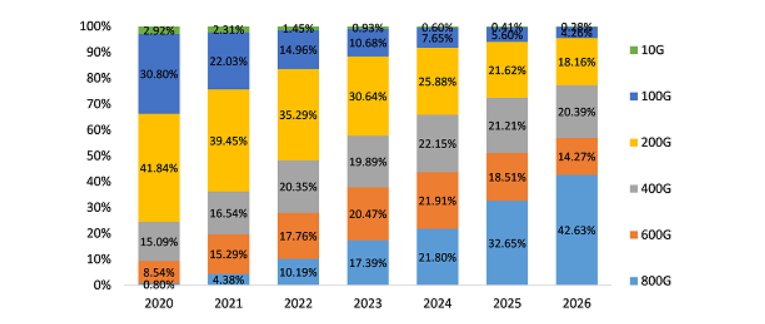

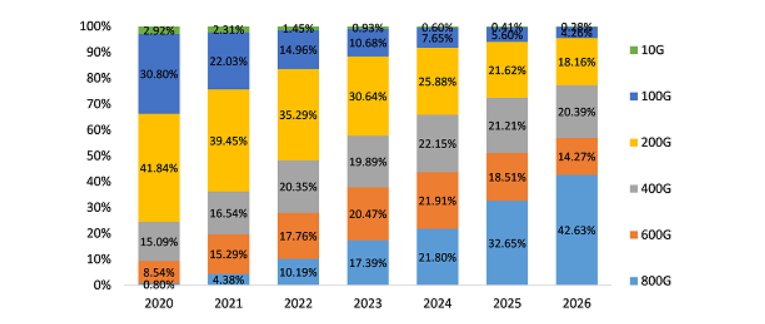

图表2:不同速率DWDM模块渗透率发展趋势(按销售收入)

数据来源:Omdia,ICC

In the telecoms application space, telecoms service providers and cloud service providers worldwide are aggressively upgrading their IP backbones to meet traffic growth. According to Omida's forecast, 10G, 100G and 200G DWDM module shipments will account for as much as 93.47% of total DWDM module shipments in 2020, but the proportion will slip to 49.05% by 2026; meanwhile, 400G, 600G and 800G DWDM module shipments will rise to 50.96% of total DWDM module shipments from 6.53% to 50.96% in 2020.

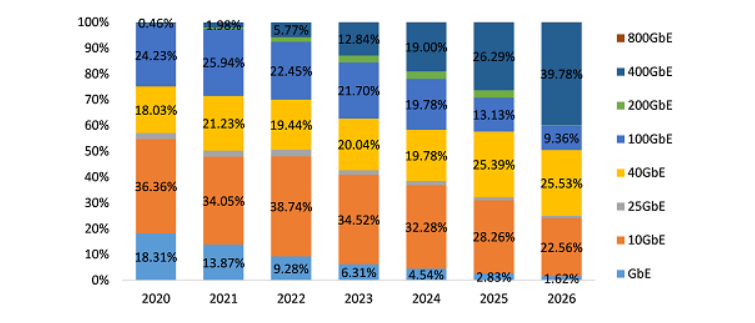

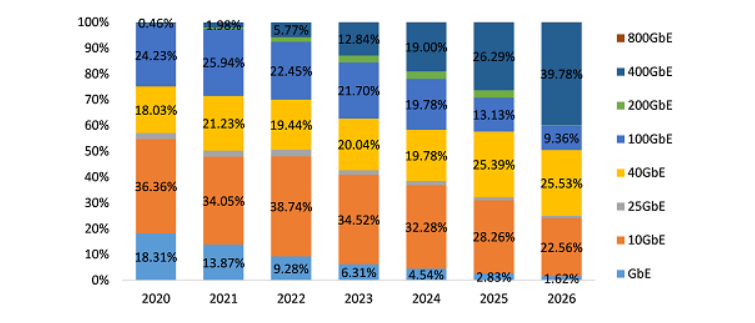

图3:不同速率数据通信模块渗透率发展趋势(按出货量)

数据来源:Omdia,ICC

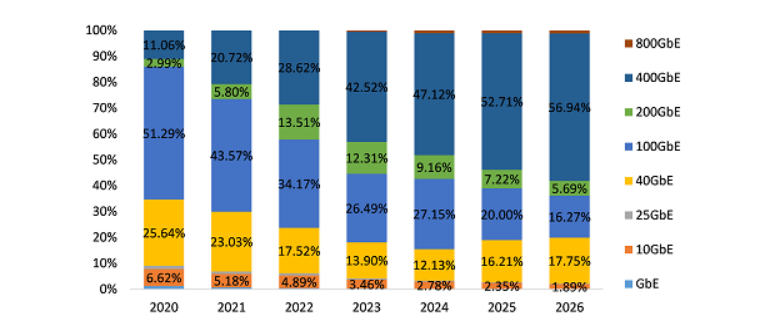

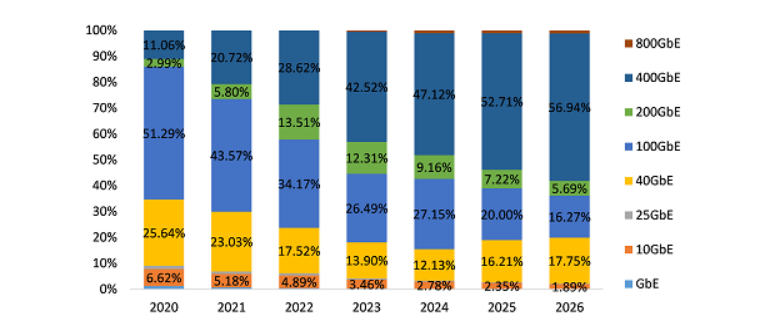

图表4:不同速率数据通信模块渗透率发展趋势(按销售收入)

数据来源:Omdia,ICC

In the datacom sector, the upcoming data centre architecture will stimulate long-term growth in investment in this market.Omidia forecasts show that 10GbE and below datacom optical module shipments will account for 54.67% of overall datacom optical module shipments in 2020, with the proportion slipping to 24.18% by 2026; meanwhile, the share of 40GbE optical module shipments will rise from 18.03% to 25.53%, the share of 100GbE optical module shipments slipped from 24.23% to 9.36%, and the share of 400GbE optical module shipments will rise from 0.46% to 39.78%. 800GbE optical modules are expected to be introduced in 2023, and their sales are expected to climb rapidly in 2025 and beyond.

It can be seen that the demand for 400G and above speed optical modules will become the mainstream of the market in the next five years.

Demand for 400G and Above Rate Optical Modules Will Become Mainstream in the Next Five Years - iccsz.com

In 2020 and 2021, there is a major shift towards working from home and home schooling under the embargo policies resulting from the new Crown Pneumonia, creating a greater demand for faster, more ubiquitous, and more reliable networks. As a result, the optical module market has seen double-digit growth for two consecutive years, despite supply chain constraints and even disruptions.2022, the epidemic is gradually being brought under control globally, but some of the habits adopted during the crisis (remote working, collaboration, online media consumption) have become part of people's daily lives, connectivity is becoming a more important asset for homes and businesses, and demand for broadband continues to grow. As a result, the global optical module market is experiencing double-digit growth, despite the supply chain challenges that remain.

Specifically, global optical module revenue growth was driven by the three application markets of DWDM, Ethernet, and PON, with strong demand for 400G coherent products for telecom DCI applications in the DWDM market. Revenue growth in the Ethernet market came mainly from 200G and 400G products. In the PON optical module market, growth drivers are almost exclusively from XG/XGS-PON OLTs.

Over the next five years, applications such as cloud computing, IoT, and artificial intelligence will continue to stimulate rapid growth in demand for Internet traffic, driving market demand for higher-rate optical module products.

图1:不同速率DWDM模块渗透率发展趋势(按出货量)

数据来源:Omdia,ICC

图表2:不同速率DWDM模块渗透率发展趋势(按销售收入)

数据来源:Omdia,ICC

In the telecoms application space, telecoms service providers and cloud service providers worldwide are aggressively upgrading their IP backbones to meet traffic growth. According to Omida's forecast, 10G, 100G and 200G DWDM module shipments will account for as much as 93.47% of total DWDM module shipments in 2020, but the proportion will slip to 49.05% by 2026; meanwhile, 400G, 600G and 800G DWDM module shipments will rise to 50.96% of total DWDM module shipments from 6.53% to 50.96% in 2020.

图3:不同速率数据通信模块渗透率发展趋势(按出货量)

数据来源:Omdia,ICC

图表4:不同速率数据通信模块渗透率发展趋势(按销售收入)

数据来源:Omdia,ICC

In the datacom sector, the upcoming data centre architecture will stimulate long-term growth in investment in this market.Omidia forecasts show that 10GbE and below datacom optical module shipments will account for 54.67% of overall datacom optical module shipments in 2020, with the proportion slipping to 24.18% by 2026; meanwhile, the share of 40GbE optical module shipments will rise from 18.03% to 25.53%, the share of 100GbE optical module shipments slipped from 24.23% to 9.36%, and the share of 400GbE optical module shipments will rise from 0.46% to 39.78%. 800GbE optical modules are expected to be introduced in 2023, and their sales are expected to climb rapidly in 2025 and beyond.

It can be seen that the demand for 400G and above speed optical modules will become the mainstream of the market in the next five years.

Demand for 400G and Above Rate Optical Modules Will Become Mainstream in the Next Five Years - iccsz.com